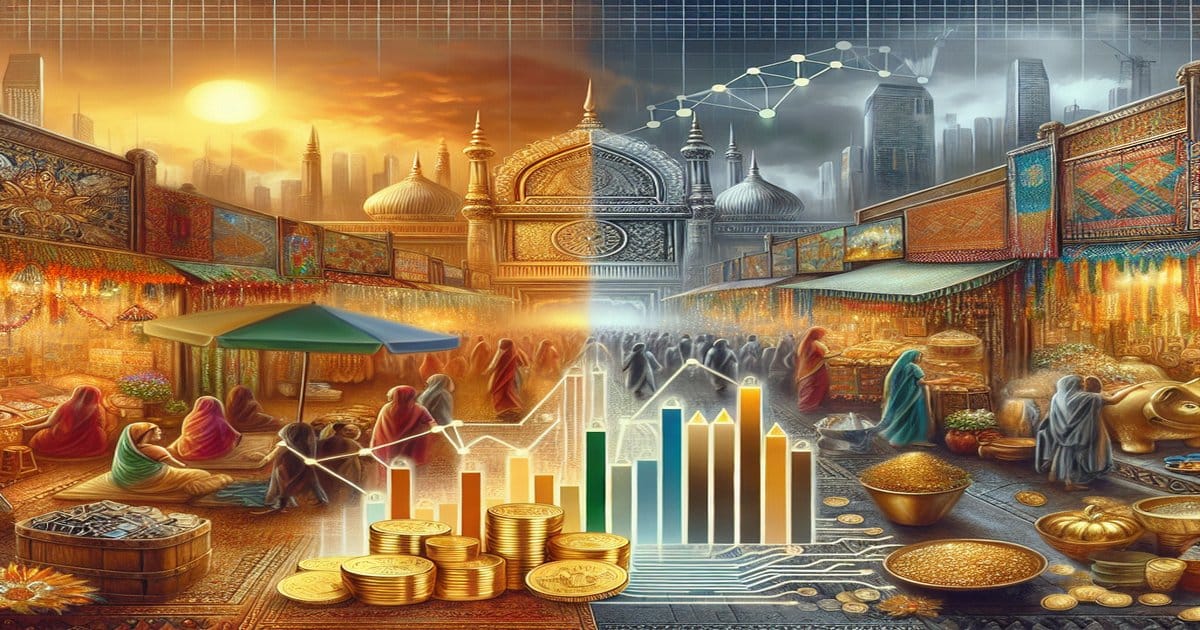

Gold vs Digital Gold - Which is Better for Indian Investors?

Gold vs Digital Gold - Which is Better for Indian Investors?

India has a unique love affair with gold. From weddings to festivals, the yellow metal is a cherished asset for many. However, with the advent of technology, a new form of gold has emerged - Digital Gold. As an investor, you might be wondering which one is better. This post will shed light on both and help you make an informed decision.

Understanding Physical Gold

Gold has been a staple of Indian households for centuries. It is not only a status symbol but also a hedge against inflation. Here are some points to consider:

- Liquidity: Physical gold can easily be converted into cash. It has an almost universal acceptance, making it a highly liquid asset.

- Security: Possessing physical gold requires you to ensure its safety. This could involve buying a safe or paying for a locker at a bank.

- Purity: The purity of physical gold can sometimes be questionable. It is essential to buy from a trusted source.

- Making Charges: When you buy gold jewellery, there are making charges involved which vary from jeweller to jeweller.

Understanding Digital Gold

Digital Gold is a relatively new concept in India. It allows you to buy, sell and hold gold in an electronic format. Let’s dig deeper:

- Ease of Transaction: You can buy or sell digital gold online at any time, from anywhere. It eliminates the need for visiting a physical store.

- Safety: Digital gold is stored in secured vaults by the provider. So, there’s no need to worry about theft or loss.

- Purity: The purity of digital gold is 99.9%. It is entirely transparent and certified.

- No Additional Costs: There are no making charges or hidden costs involved in buying digital gold.

Gold vs Digital Gold: The Comparison

Let’s compare both on various parameters:

Liquidity

- Physical Gold: High liquidity as it can be sold at any jewellery store.

- Digital Gold: It can be sold online instantly. However, the money might take some time to reflect in your account.

Safety

- Physical Gold: High risk due to possibilities of theft and loss.

- Digital Gold: Very safe as it is stored in secured vaults by the provider.

Purity

- Physical Gold: Purity can be questionable unless bought from a trusted source.

- Digital Gold: The purity is 99.9% and certified.

Cost

- Physical Gold: Additional costs like making charges and locker rental.

- Digital Gold: No additional costs, but a small fee is charged for storage and insurance.

Which is Better for Indian Investors?

The answer depends on your individual requirements. If you prefer holding a tangible asset, then physical gold might be a better option. However, if you’re looking for ease of transaction, safety, and zero additional costs, then digital gold is the way to go.

Remember, diversification is key in investing. You can always allocate a portion of your portfolio to both physical and digital gold. This way, you can enjoy the benefits of both and potentially increase your overall returns.

In conclusion, both physical gold and digital gold have their own set of advantages and disadvantages. As an investor, you need to weigh them according to your investment goals. Always stay informed and make smart decisions.

In the end, whether it’s gold or digital gold, the aim should be to grow your wealth and secure your financial future. Happy Investing!